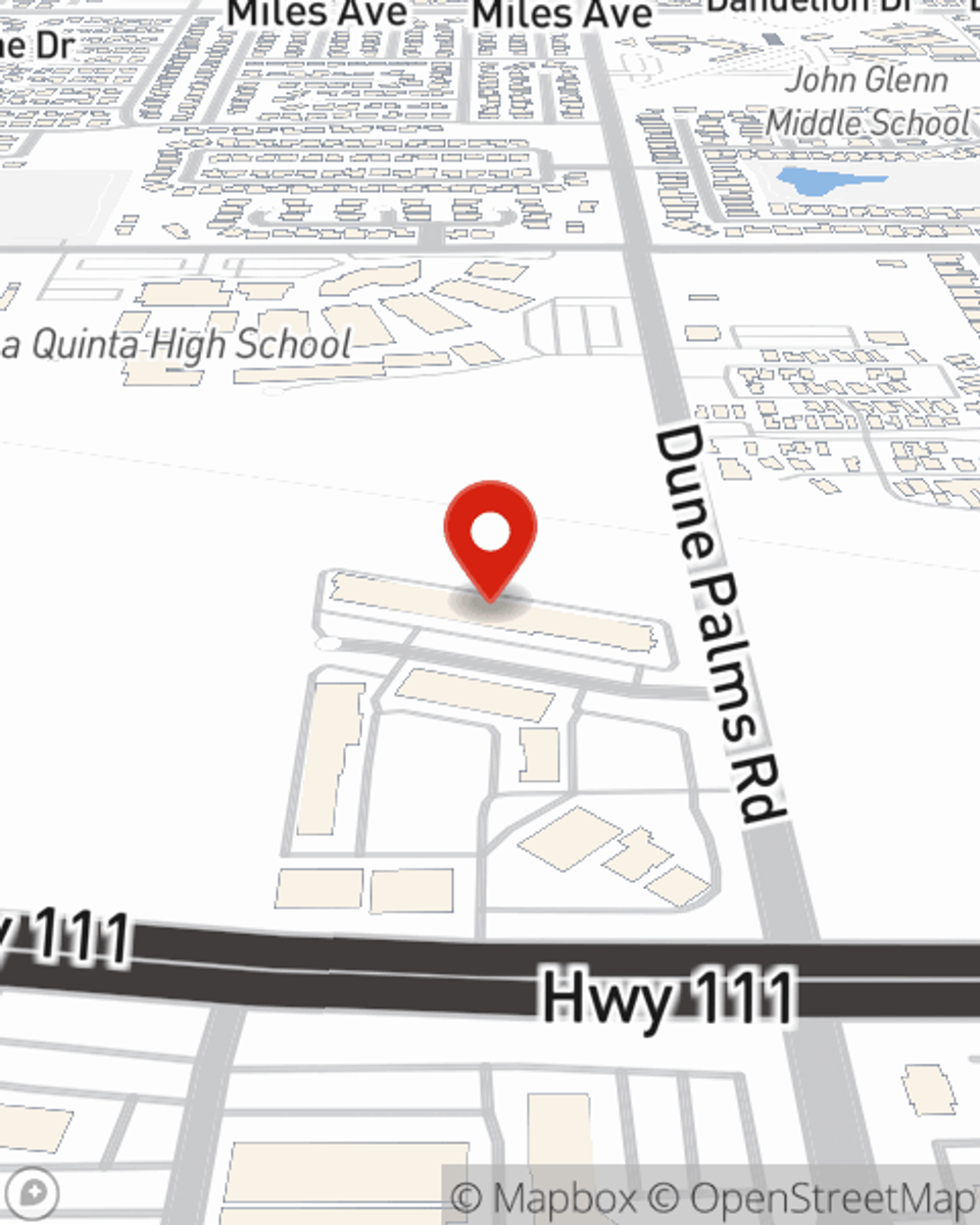

Insurance in and around La Quinta

Bundle policies and save serious dollars

Great insurance and a great value

Would you like to create a personalized quote?

Celebrating 100 Years Of Good Neighboring

You’ve worked hard to get to where you are. But the world can often throw the unexpected at you. Let State Farm® insurance help protect you, your loved ones and the life you’ve built. Find a coverage plan that protects what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts, you can create a solution that’s right for you. Contact John Ford today for a Personalized Price Plan.

Bundle policies and save serious dollars

Great insurance and a great value

We’re There When You Need Us Most

Want to know why State Farm is the largest insurer of automobiles and homes in the U.S.? Great insurance coverage options, competitive prices, easy claims and excellent service might have a lot to do with it. Or maybe you're looking to help secure your family's financial future. Let us help you ease that burden. The unmatched strength of State Farm Life Insurance, a wide range of products and Personalized Price Plans; it's a great value and smart choice.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Recognize IRS scams to better protect yourself

Recognize IRS scams to better protect yourself

Common tax scams like telephone scams, phony tax preparers & phishing emails/websites can cost you plenty. Read more from State Farm to help stay safe.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Recognize IRS scams to better protect yourself

Recognize IRS scams to better protect yourself

Common tax scams like telephone scams, phony tax preparers & phishing emails/websites can cost you plenty. Read more from State Farm to help stay safe.